Vision Insurance

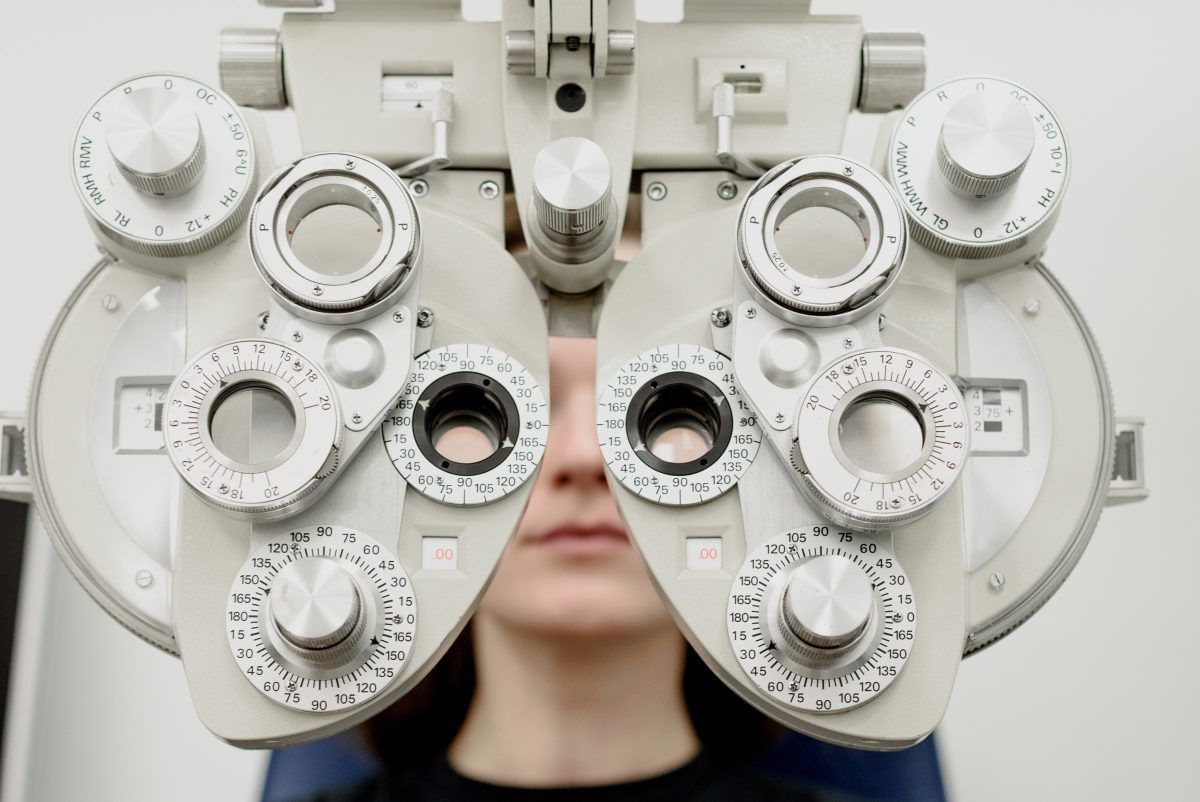

REASONS TO HAVE VISION INSURANCE

- Cost savings: Reduce expenses for routine eye exams, prescription eyewear, and eye surgeries.

- Regular eye care: Encourage consistent eye exams to maintain vision health and detect early signs of eye diseases.

- Access to quality providers: Connect with a network of vetted eye care professionals.

- Customized eyewear options: Obtain affordable prescription glasses, contact lenses, and specialized lenses.

- Eye health management: Receive coverage for treatments related to eye conditions and surgical procedures.

- Additional benefits: Enjoy discounts on vision correction surgeries, coverage for safety eyewear, and medically necessary contact lenses.

YOU AND YOUR EYES DESERVE TO BE HEALTHY AND HAPPY.

WE CAN HELP!

QUALITY CARE YOU DESERVE

You deserve a WellVision Exam®—a comprehensive eye exam that can help detect early signs of health conditions, like diabetes. And with about five VSP® network doctors within six miles of you, it’s easy to find an in-network doctor.

STYLES YOU’LL LOVE

Find hundreds of frame options to choose from and get an extra $20 to spend on featured frame brands like bebe, CALVIN KLEIN, Cole Haan, Flexon®, Lacoste, Nike, Nine West, and more. Plus, save up to 30% on lens enhancements!

SAVINGS YOU EXPECT

You’ll get low out-of-pocket costs on your vision care essentials including access to member-exclusive offers and savings. Typical annual savings are over $200

USING YOUR VSP BENEFIT IS EASY.

- Create an account at vsp.com to see your plan information.

- To find an in-network doctor based on your plan-type,

visit vsp.com or call 800.877.7195. Maximize your

coverage with bonus offers and savings that are exclusive

to Premier Program locations- including thousands of

private practice doctors and over 700 Visionworks retail

locations nationwide. - At your appointment, tell them you have VSP

VSP and your doctor will handle the rest—there are no claim forms to complete.

There are several reasons why purchasing vision insurance can be beneficial:

- Cost savings: Vision insurance can help offset the cost of routine eye exams, prescription eyewear (glasses or contact lenses), and even certain eye surgeries or procedures. Without insurance, these expenses can add up quickly, especially if you have a family or require specialized eyewear.

- Regular eye care: Vision insurance encourages regular eye care by covering the cost of routine eye exams. Regular eye exams are essential for maintaining healthy vision and detecting early signs of eye diseases or conditions such as glaucoma, cataracts, or macular degeneration. Early detection and treatment can prevent or minimize vision loss.

- Access to quality eye care providers: Vision insurance often provides a network of eye care professionals, including optometrists and ophthalmologists, who have been vetted by the insurance company. This ensures that you have access to quality eye care providers who can provide comprehensive eye exams and prescribe the appropriate vision correction solutions.

- Customized eyewear options: Vision insurance typically includes benefits for prescription eyewear, including glasses or contact lenses. This can help reduce the cost of obtaining the correct prescription lenses or purchasing stylish frames. Some plans may also cover specialized lenses like progressive lenses, bifocals, or high-index lenses.

- Eye health management: Vision insurance can support ongoing eye health management by covering treatments for various eye conditions. This may include coverage for conditions like dry eyes, eye infections, or allergies. Depending on the plan, it may also cover surgical procedures such as LASIK or cataract surgery.

- Flexibility and additional benefits: Some vision insurance plans offer additional benefits such as discounts on LASIK or other vision correction surgeries, coverage for safety eyewear, or coverage for medically necessary contact lenses. These additional benefits can provide further value and savings for individuals with specific needs.

It's important to carefully review and compare different vision insurance plans to find one that aligns with your specific needs and budget. Consider factors such as premiums, coverage limits, network providers, and the extent of coverage for various eye care services and products.

Who is Covered

You have options on who can be covered on your vision insurance plan

- Your Self

- You and your Spouse

- The whole family

Premium's will Range depending on your choice of coverage levels.