auto insurance

Next-gen car insurance that'S fast, easy, and affordable

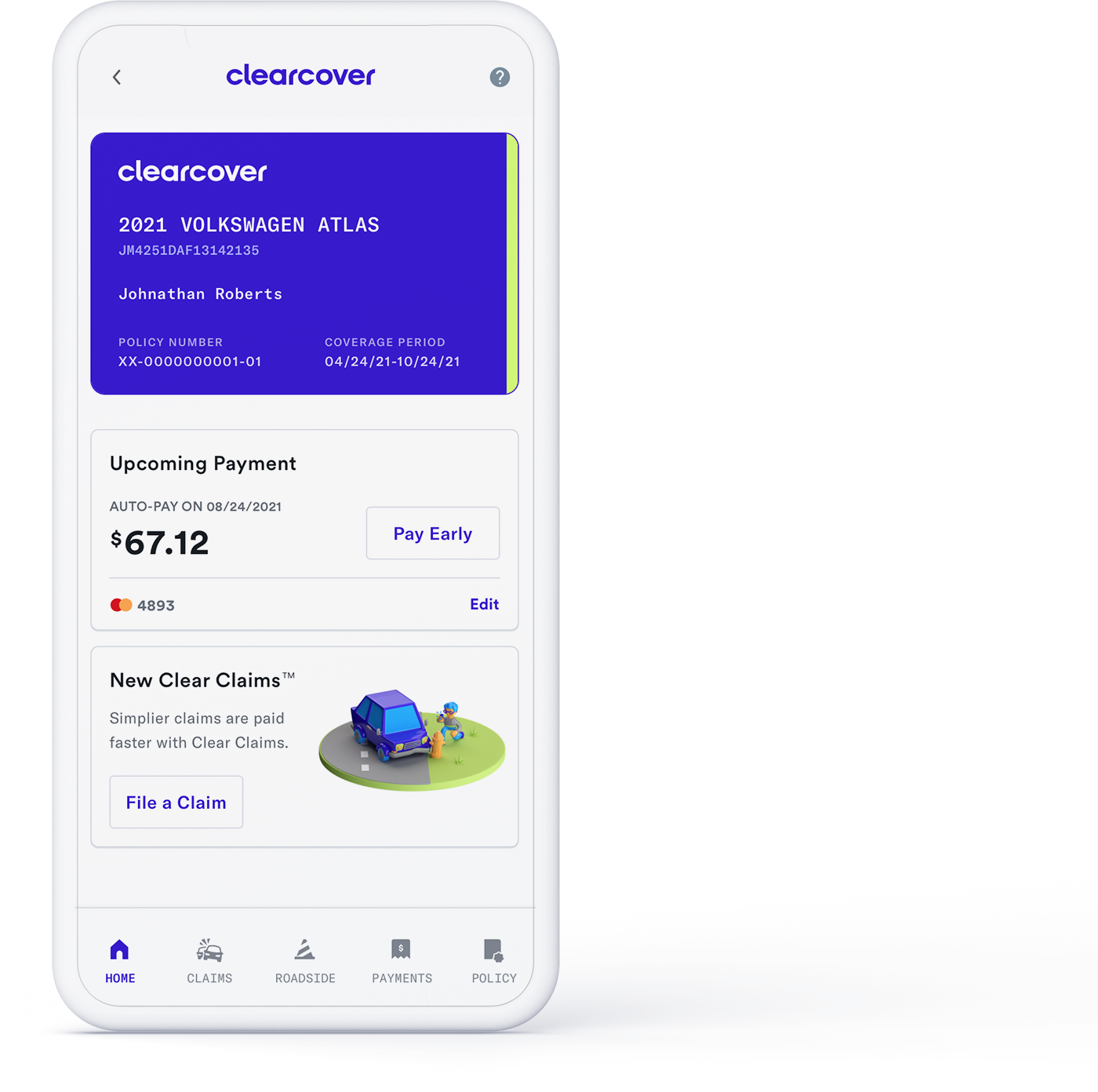

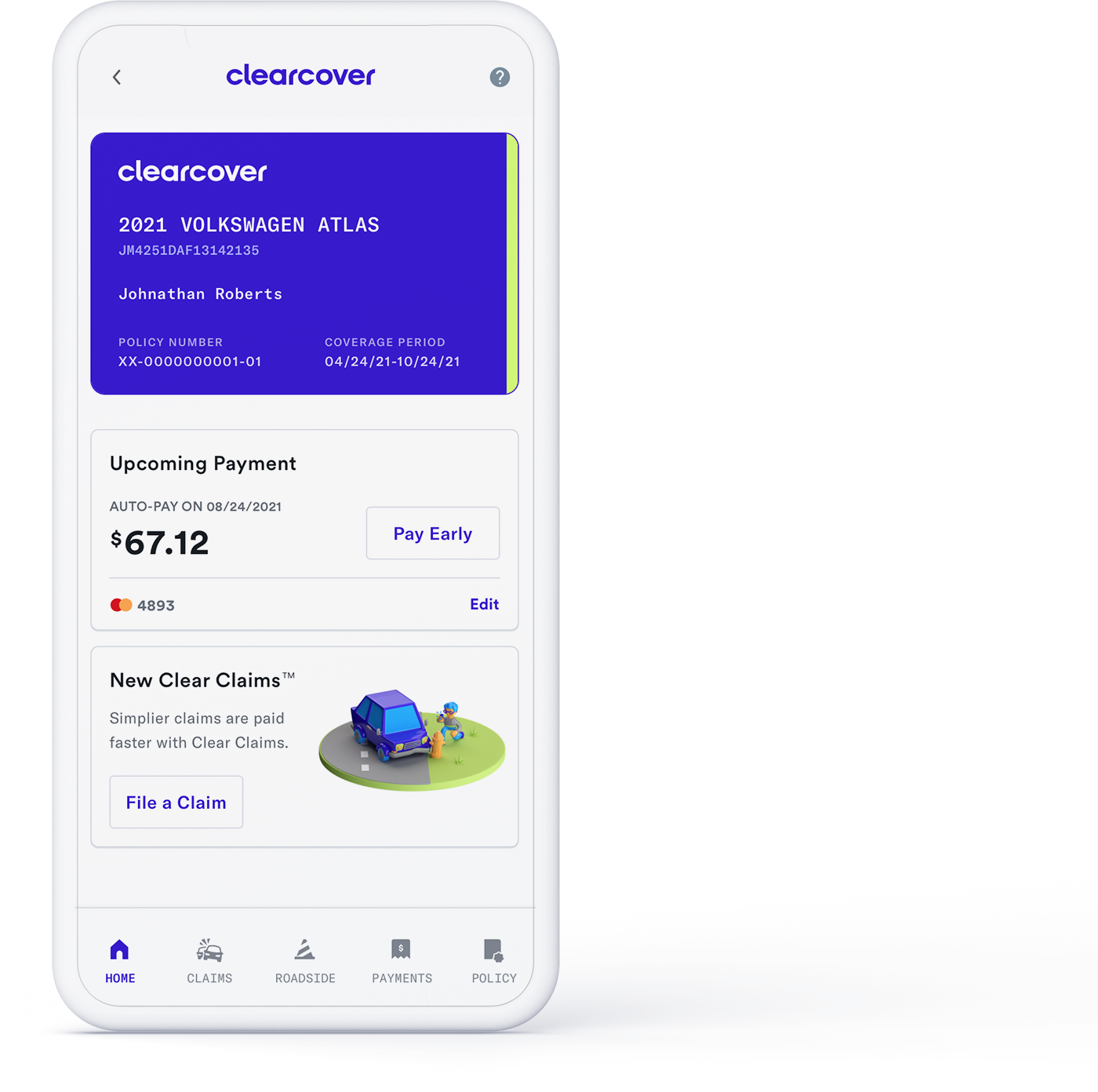

Online Insurance Hub has partnered with Clearcover to provide auto insurance that provides coverage at great rates and driven by technology to make paying your bills, filing claims and viewing your policy fast and easy.

Find the right coverage, file claims instantly, and get help fast-all in one game-changing app.

IT’S EASY TO SWITCH... AT ANY TIME.

...even if your current insurance term isn’t over! Get a free, no-obligation quote in minutes.

gET A NO-OBLIGATION QUOTE.

We'll tell you how much you could be saving- in just a few minutes

The fastest claims in car insurance

With our unique claims AI technology...

we can pay eligible claims in minutes.

Considering Clearcover

-

About 12-month vs 6-month auto policies

Rather than selling 12-month policies, Clearcover policies provide coverage for a 6-month term. This shorter term allows us to evaluate your driving history more frequently, which ensures that you save as much money as possible!

-

About Rideshare Coverage

If you drive for a rideshare company like Uber or Lyft, then you can add Clearcover's Rideshare endorsement to extend coverage during Period 1 driving. Here is how ridesharing driving periods are defined:

Period 1 — The rideshare app is turned on, but you have not yet accepted a ride.

Period 2 — You have accepted a ride and are on your way to pick up a rider.

Period 3 — The rider is in your vehicle.

Ridesharing companies generally extend coverage to your vehicle while you are in driving Periods 2 and 3, but we encourage you to verify this with them.

Clearcover considers ridesharing to be the transportation of one or more people from one point to another through an online-enabled application or platform of a transportation network company.

Important: Clearcover does not extend coverage for the delivery of food or items, which means that our rideshare endorsement does not cover UberEats, Grubhub, DoorDash, Postmates, Instacart, or any other delivery driving service.

To add the rideshare endorsement to your Clearcover policy, you can chat with one of our Customer Advocates through the Clearcover app or call us at 855-444-1875 during business hours.

-

About Alternate Transportation coverage

Alternate Transportation coverage allows you to stay mobile while your vehicle is not drivable due to a covered incident. When you have Alternate Transportation coverage, Clearcover reimburses you based on how you decide to get around – whether that's using ridesharing services, taking public transportation, or renting a car from the company of your choice.

Alternate Transportation coverage includes two numbers. The first number is the maximum amount that we will reimburse per day, and the second number is the maximum amount that Clearcover will reimburse for a single incident. If you purchase $30/$900 coverage, for example, then Clearcover will reimburse up to $30 per day, for a maximum of $900 for an incident, for your alternate transportation expenses.

You can only use Alternate Transportation coverage in the event of a covered loss, which is an incident for which you file a Clearcover claim. Alternate Transportation coverage does not apply to a vehicle's regular maintenance or mechanical repairs.

-

Coverage Discounts

Clearcover believes that everyone deserves affordable auto insurance. With this in mind, we took most of the savings that big insurance companies only offer as discounts and made them a standard part of our pricing. You can save money with Clearcover through safe driving, vehicle safety features, electronic documents, and paying upfront, but with us, you don’t have to look for or select those discounts. Instead, we automatically build them into your price for you!

We offer additional discounts to customers in the military. In all states, active military personnel receive a 15% discount on their rate. In Louisiana, we offer an additional 25% discount for customers who are on active duty, as well as for their children who are under the age of 25.

-

SR-22 Documentation

An SR-22 is a certificate of financial responsibility required for some drivers by their state or court order. It is not an insurance policy, but rather documentation that proves a driver has car insurance coverage.

Unfortunately, Clearcover is unable to provide SR-22s to prospective customers looking for a quote.